NeuroLOB

Generative Market Intelligence using Neural Point Processes & Diffusion. Live Demo

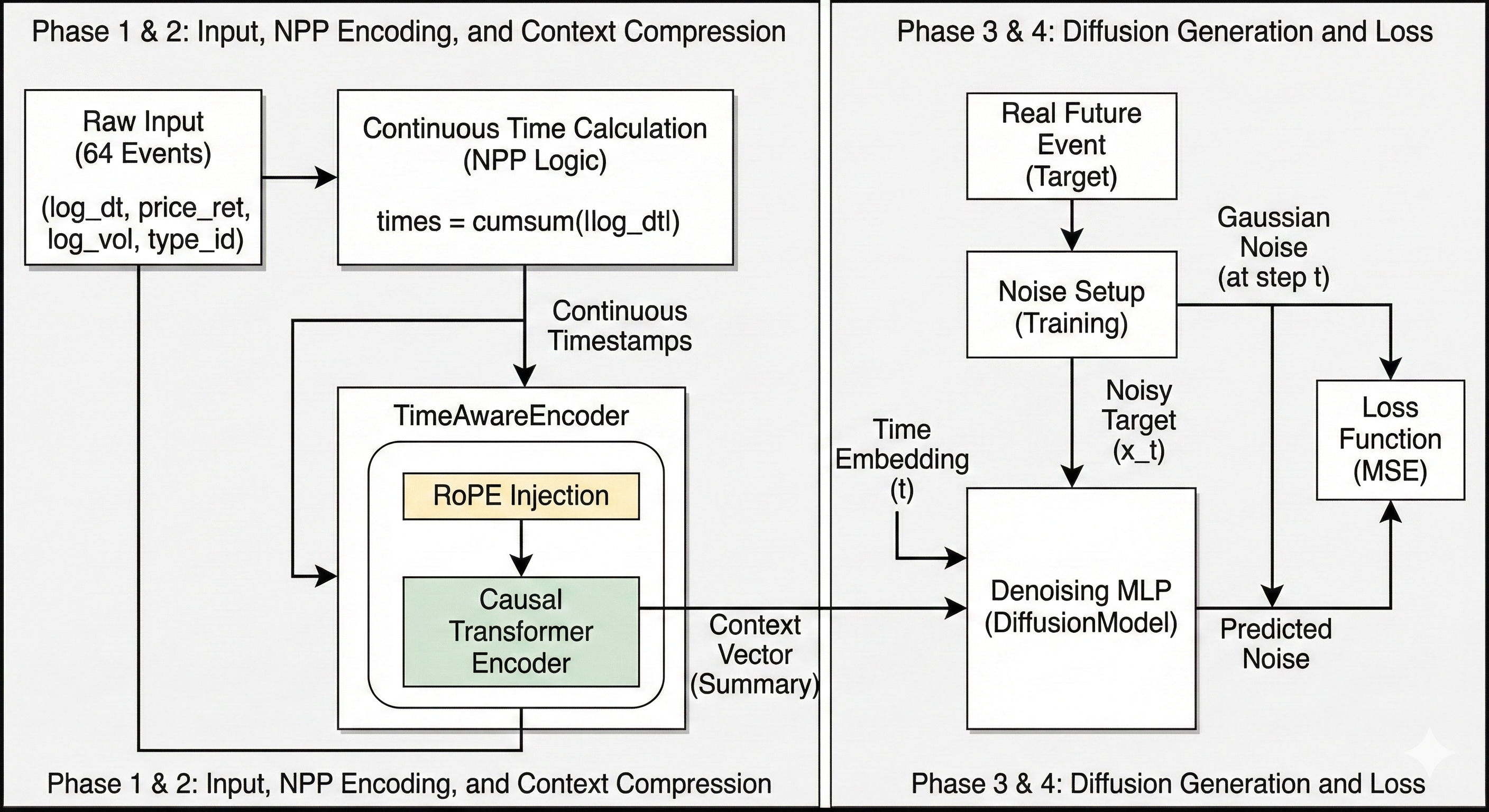

Abstract Financial microstructure data (Limit Order Books) is event-driven and irregular. NeuroLOB is a neuro-symbolic framework integrating Neural Point Processes (NPP) with Diffusion Models to generate high-fidelity synthetic market data.

System Architecture

To bring this research model to the web, I implemented a Hybrid Cloud Architecture:

- Frontend: Static portfolio hosted on GitHub Pages.

- Backend: Containerized inference engine hosted on Hugging Face Spaces.

- Model: The

DiffusionPipelineruns on a custom PyTorch backend.

Key Innovations

- Continuous Time Encoding: Implemented Rotary Positional Embeddings (RoPE) to inject continuous time information directly into the attention mechanism.

- Diffusion-Based Generation: Used a conditional DDPM to capture the multi-modal distribution of price returns.

- Physics-Informed Regularization: Enforced financial stylized facts (fat tails and volatility clustering) using a GARCH(1,1) post-processing layer.